Seaman Loan - No Post Dated Cheque 1 Day Philippines Lending with 1.75% Low Interest and Non Appearance No Coborrower Option

Looking for fast cash release loan offer for OFW? 1 day seaman loan is the one of

a kind credit for sea-based worker abroad.This OFW maritime loan is currently available only in the Philippines and is the fastest loan being

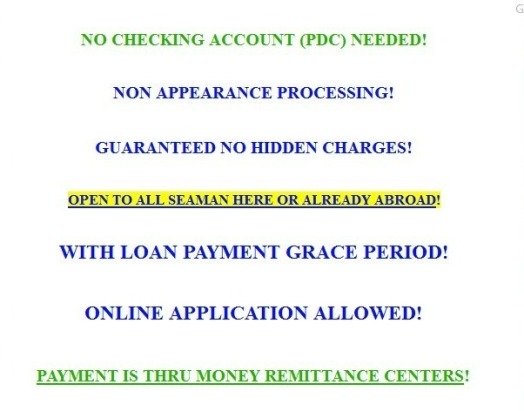

offered today in the country. My Pilipinas offers assistance for No Post Dated Check / Non Appearance option for only a low interest of 1.75% rate only.

If you have full, complete and

the right or sufficient requirements and requisites to submit, you will surely get your loan amount in as fast as 1-3 hours. Seaman also no longer requires seafarers to have a checking account (PDC). Payment is thru money remittance centers like Palawan Express, M Lhuilier, Cebuana Pera Padala and 7-11 EC Pay.

Payment system is via your nearest remittance centers, payment centers and pawnshops allowing gateway for sending money. One of our providers also allows processing via non-appearance. All you have to do is to submit the complete requirements via our email address listed below and call us for confirmation if we received your documents.

(home office phone: 542-8105 / 542-7015 ) or (Sun Cellular No 0932 - 872 5532) or (Smart Cellular No 0939 - 9269335) / (Globe No 0905 - 4249367 [with Viber]). You may also CHAT or send your completely filled up application form at info.seamanloan@gmail.com.

See list of requirements below or compute your own monthly remittance amount via a simple loan calculator.

Apply now to my tatay Sam. He is a professional freelance Pinoy loan consultant based in Makati who has his own website and is probably one of the first ones to go promoting his lending company loan offers online via advertising. Please note that safety of life at sea is not part of the requirement when you apply for this non-collateral personal loan for seafarers. You may read information here - SOLAS.

Seaman Loan Requirements and Documents Needed for Application

- Standard contract with POEA validation

- Updated (not expired) Passport photocopy

- Seafarer's Registration Certificate (SRC) photocopy

- Seaman's Book (latest, valid and updated)

- Marriage contract or Birth certificate of children (if married or living-in with common law wife) OR birth certificate of seaman (if single and coborrower is either parent or brother or sister)

- Overseas Employment Certificate (OEC) (Latest and must be duly validated by POEA)

- Proof of Billing (Electric or Water Bill Only) (even if not under your name as long as with same address as valid IDs)

- 1 Co-Borrower (can be wife, sister, brother, mother or father even without income)

- 2 pcs of 2x2 picture

Co-Borrower Requirements and Necessities

- Co-borrower must present 2 valid IDs (latest) with picture

- 1 proof of billing (electric or water bill only) (even if not under your name as long as with same address as valid IDs) (no need to submit bill if living with seaman under the same address)

- 2 pcs of 2x2 picture

Alternative Proof of Residency and Identification if Needed Only

- Old documents

- Children's old school ID

- Transcript of record from school or form 137 duly notarized and with official school seal if possible

- Remittance bills from banks or money remittance / transfer centers

- Voter's ID (old or new)

- Old police clearance

- Payment receipts with name and address indicated

- Old NBI clearance

If you have the latest updated POEA-validated contract and OEC and with complete set of documentary requirements to submit, call us ASAP for fast application for seaman loan or fill up our online form below to qualify for 1 day release loan. We will get back to your inquiry as soon as we read it in our email.

How to Get Your Loan Application Approved Fast?

As an experienced loan consultant for different Philippine business in the lending industry, I asked this question to my father who is assisting me on this very long discussion and article writing. My question is, how do you get your loan application approved fast?

Answer: No hanky panky with your documents, nothing fake, nothing fancy. Just provide what the loan consultant asks from you with respect to documentary requirements for mariners. If you don't have one, always ask for an alternative and again, do not submit fake or false documents. Another secret of my dad is that he immediately subjects all his sailor client to a short 1-2 minute pre-qualifying interview. This enables him to know outright who qualifies and who doesn't plus he also immediately knows which particular lending company a loan borrower can qualify.

Your seaman loan application will definitely be turned down!

To learn more about your options for borrowing money, please read the type of fast cash Philippine loans offered today in Metro Manila and nearby provinces. It will help you to speed up your application too by reading this tip.

Loanable Amount, Terms of Payment, Interest Rate and Processing Fee

|

With respect to seaman loan, most terms of payment vary from 3 months to 1 year only. But basically, lending companies only allow a loan payment term based from the contract of the maritime worker. Meaning, if you only have a 6 month contract, you can only get a maximum of 6-month loan term with respect to payment options. |

As a loan consultant, I serve clients for free because we get paid by our company. You definitely won't get charged for my assistance service.

On the other hand, if you ask about interest rates, there are currently only 2 choices.

Interest Rate:

- Choice #1: 1.75% interest

- Choice #2: 2.75 % interest

With respect to processing fee, there are also 2 available choices for you. This will definitely affect your take home loanable amount so be critical in choosing based from your current need for cash.

Processing Fee:

- Choice #1: 5% of the loanable amount

- Choice #2: 9.9% of the loanable amount

The catch here is that if you want to take home a bigger cash with you upon loan approval, you should opt in for the 11.0% processing fee because add-on charges will apply. But alongside with this choice, you get a bigger processing fee rate for your loan but will not affect your remittance which will be equivalent to whichever amount you want to send to your spouse or allottee.

On the other hand, if you choose to want to pay a little less each month, you should opt in for the 9.9% ONE TIME PAY for the processing fee because this will only give you a monthly add on interest rate of 2.75% for your loan payment or remittance to the bank where you will apply for a checking account as part of the collateral of your seaman loan to the approving lending company.

How is the loanable amount computed?

The answer is, the loan consultant or loan agent cannot compute or make assumptions as to how much will be the loanable amount of a seaman loan applicant. The reason is because this is being done after the process of submitting your full list of requirements and after you are pre-screened to qualify to apply for the said type of loan in the Philippines.

The only monetary data or numerical value that a loan consultant can give you is the estimate loanable amount. There is and will never be guarantee that this amount will be your loanable amount. This is just based from the experience of a loan assistant which he or she gets from the previous applicants that have had approved accounts with the lending company. Again, don't ask for loanable amount, just ask for an estimate and don't forget to give your basic pay onboard by the shipping agency. This is a base figure for estimating loanable amount.

Other Loan Products to Apply for Aside from Seaman Loan

If you didn't know it yet, seafarer cash advance is today's most popular type of lending in the Philippines. That is because of the fact that Filipino maritime workers are much preferred by shipping agencies like PTC in Makati and other big manning agency in Manila.

But apart from this fact, I would like to let you know about the good news. If you have a problem and you can qualify for the seaman loan, you still have other choices. My Tatay Sam is offering alternative types of loan products as listed below.

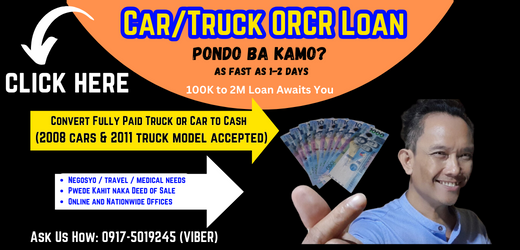

- Jeepney Loan

- Car Loan Without Taking Your Car

- OFW Loan

- Tricycle Loan

- Salary Loan

- Doctors Loan

- Taxi Loan

- Real Estate Collateral Loan