Tricycle Loan - Lowest Interest, Terms and Where to Apply

It is hard to come up with a provider if you want to apply for tricycle loan in the Philippines. But with the help of your qualified loan agent, that would be easy. Talk to me now by calling my hotline numbers below.

Many borrowers view this to be the same as financing for people looking to buy a motorcycle package with complete set and ready to use and monetize.

Fact is, the tricycle loan we have gone used to finding online searching for providers is not about acquiring or buying a new unit and finding a lending company or financing company willing to have your dream tricycle mortgaged under their program.

The motorcycle loan I am talking about does not even mention the kind of personal loan with banks where you can usually apply to get financing to mortgage a motorbike you want to buy and probably ask for additional cash loan to buy the sidecar and mayor's permit plus franchise.

In short, the kind of trike loan I am talking about is that wherein you already have a complete set of unit, already running with yellow plate, franchise and MTOP (Motorized Tricycle Operator's Permit and you are looking forward to use the vehicle as collateral to get instant quick cash. A collateral loan that is a secured type but does not even need the borrower to have a regular or steady source of income to be qualified to borrow money.

How to Qualify to Apply for this Type of Collateral Secured Loan

If you are to ask me, I would mostly prefer not to call this type of loan as a secured loan.

The fact that there is even no need for the tricycle owner or borrower to have a regular source of income to qualify to apply for this loan attests that this is actually just a semi secured loan since there is really no guarantee that the loan applicant, should he or she be approved of the loan application does not really need a stead source of income apart from the boundary of the tricycle itself.

This set up makes it a 50/50 chance that the owner of the tricycle may not be able to pay for the loan applied for. Therefore, I prefer it best to call this a semi secured collateral loan.

How to Qualify to Apply:

To qualify, you must first pass certain lending company standards both as expected from the unit to the borrower. Below is a list of pre-qualifying requirements.

- Borrower must be the registered owner of the tricycle as stated in the OR / CR (official receipt / certificate of registration).

- Vehicle must have MTOP, franchise and is already in yellow plate.

- Vehicle must either be a 4 stroke motorcycle unit or the regular 2 stroke with year model of at least 1995 and newer.

- Owner does not need a regular source of income nor a proof of income to qualify.

- OR / CR must not be encumbered in other financing company or any individual (this will be verified at the LTO) and is not under mortgage (must be fully owned)

- Registered vehicle owner must have a TIN ID / number.

Tricycle Loan Requirements, Processing, Interest Rates, Appraisal and Loanable Amount

Appraisal value of the tricycle to be used as collateral is determined by physical condition, year model, mileage and type of motor vehicle (4 stroke or 2 stroke). The newer the model year, the higher possible loanable amount may be approved.

Application Requirements:

- Latest valid and registered OR / CR

- Copy of valid and updated MTOP or tricycle franchise

- TIN ID or number of borrower

- 2 valid primary IDs

Processing Time and Fees:

- 1-5 working days processing time

- 2%-2.75% interest rate add on per month

- Php 15,000 - Php 25,000 loanable amount

- 4% processing fee will be deducted in loan proceeds

- 12 months maximum loanable amount

Where to Apply for Tricycle Loan - Collateral

So now you know the different aspects of a tricycle loan but let me remind you first and foremost that you cannot find any bank that accepts motorycle loan with a sidecar to use as collateral. It's about time you find the right lending company to apply for it. Well, don't look anywhere else. Just contact me using the details below to apply for this particular loan.

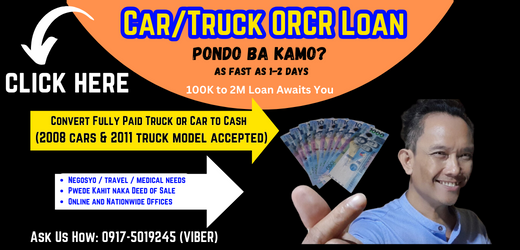

Call to apply for a Tricycle Loan - Sam Casuncad (loan consultant) (home office phone PLDT: 366 3645 / 542 7015) or (Sun Cellular No 0932 - 872 5532) or (Smart Cellular No 0919 - 2933853) / (Globe No 0917 - 5019245). You may also CHAT or send your inquiry or completely filled up application form in my email address - samcasuncad.ofwcashloan@gmail.com.

Other Types of Philippine Loan Offers

There are many other types of loans in the Philippines. Below is just a shortlist of available options to apply for in case you need fast loan or quick cash.

|

|

|